Oil prices have stabilized somewhat around the $60 per barrel mark, and over the past few weeks oil has shown less volatility than what we have grown used to in the preceding six or seven months. Emad Honarparvar, CEO of Modiran Trading says: "Iran and Saudi Arabia continue to contradict in benefits from new oil prices, and this is not only about economics."

Oil Products like Bitumen, Base oil, Fuel Oil etc are also influenced strongly by the new rates and face a sharp drop. "for many Iranian merchants, new oil price, which caused higher USD to Rial rate as well, resulted in more competitive position in the market comparing to other rivals like Qatar etc." he added.

But another swoon could be just over the horizon. That is because oil producers are starting to run out of storage. As production has soared and global demand has failed to keep up, oil producers have been diverting oil into storage tanks at a remarkable rate since last summer.

The latest EIA data shows that weekly inventories jumped by another 7.7 million barrels, with total inventories now having reached 425.6 million barrels. That is the highest level of oil sitting in storage in over 80 years, and more than 20% higher than the five-year average.

The data is also important because it highlights two things. First, oil production has not leveled off yet, despite several months of prices sitting below the breakeven mark for many producers. But also, the data indicates that U.S. producers may soon start to top off storage tanks. If production does not decline and oil storage capacity begins to run out, the glut of oil on the market could worsen pretty quickly, sending prices down once again.

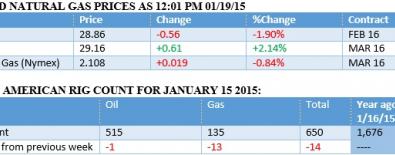

Rig counts continue to decline amid weak prices. Data from North Dakota shows that drillers are retreating to core production areas, or “sweet spots.” The number of North Dakota rigs in operation has fallen from 190 to 121, dipping below a key threshold of 130 that state regulators believe is critical to keeping production from contracting. But importantly, rig counts have fallen much quicker in the periphery, with rigs becoming increasingly concentrated in just four North Dakota counties that account for 89% of the state’s production. Still, the core areas are not necessarily safe, and a few more months of weak prices could finally lead to a drop in production.

On the other side of the world, the Russian Arctic is also seeing a pullback in activity. Although the culprit is not entirely, or even primarily, the collapse of oil prices, Russian state-owned firm Rosneft has announced plans to postpone exploration of 12 Arctic licenses. Rosneft had ambitious plans to tap Arctic oil with the help of several international oil majors, but western sanctions have forbidden the involvement of those firms. While the Russian government originally scoffed at western sanctions when they were introduced last year, the major delay to Russia’s Arctic dreams demonstrates that the West’s ploys are having a bite.

When adding in the deteriorating currency and depressed oil prices, Russia may produce 560,000 barrels less per day in 2020 than it otherwise would have, according to the International Energy Agency. That is a 5% reduction from what the agency previously forecasted. The IEA argues that Russia is likely to be the “top loser” from the oil bust.

Meanwhile, in the short-term, Russia’s dispute with Ukraine over natural gas pricing is once again coming to a head. Gazprom has insisted that Ukraine has only paid for gas through the end of the week, and has threatened to cut off supplies if it does not receive payment. Interestingly, Russia has hinted that it would still supply gas to rebel-controlled territories in eastern Ukraine. Despite the bluster, Ukrainian and Russian energy ministers are set to meet in Brussels in the coming days, raising hopes that the two sides can once again ink a deal, even if it is only temporary.

Other oil exporters are also showing more and more signs of strain. Norway released figures that show that the country’s exports have fallen by more than 18% year-on-year for the month of January. The shrinking volume of exports compounds the financial blow to the country – revenues have collapsed by half over that time period because of the combined effect of falling exports and falling prices.

However, Norway is in a stronger position than Brazil, another major oil producer. Moody’s Investors Service slashed the credit rating for the state-owned oil company Petrobras, dropping it to “junk” status. The corruption probe that has widened in recent months is taking its toll. Already the world’s most indebted oil company, Petrobras’ fortunes have taken a turn for the worse over the last six months. The company has succeeded in destroying much of its value, with its market capitalization falling from $310 in 2009 down to just $45 billion today. The looming liquidity crisis potentially facing the iconic Brazilian firm has raised market concerns that the Brazilian government may need to step in and bail the company out. Top Brazilian officials have played down such a scenario. "The government is not planning to make any cash transfers to Petrobras,” Reuters quoted one official saying on February 25.

On the demand side of the equation, there are some signs that global consumers are beginning to pick up the slack. In a recent speech Saudi Arabia’s oil minister Ali al-Naimi said that the recent rise in oil prices to $60 per barrel is evidence that demand is rising and “calm” is starting to return to market. There are some data points to back up his claim. According to Energy Aspects, a British consultancy, oil demand increased by 2.2 million barrels per day in December 2014 from the same month a year earlier. That is the fastest rate of demand growth in over a year and a half. The Saudis have said since last November that they would allow the markets to find an equilibrium, and that may indeed be beginning to happen.

While demand for crude is showing some signs of life, the final deathblow is drawing near for the infamous Keystone XL pipeline. U.S. President Barack Obama vetoed legislation this week that would have explicitly approved the pipeline’s construction. His Republican rivals in Congress have vowed to hold a vote to override the President’s veto, but they are widely expected to come up a few votes short. That leaves the project back to where it started – awaiting a final and conclusive up or down decision by the President. There is a growing consensus that he will kill the pipeline once and for all. Despite his insistence that he merely opposed the procedural runaround pushed by the most recent legislation and that he may “still” approve the pipeline, at this juncture his veto makes final approval unlikely.

source: oilprice.com

news digest and comments by www.buy-bitumen.com